This Ratio Says Silver Prices Could Double or More

Gold prices have been making record highs lately. The yellow precious metal surged past $2,200 an ounce, and it looks like it could go a lot higher. In the midst of this, don’t ignore silver prices. The gray precious metal has been lagging a bit, and it’s got a lot of catch up to do. That means big rewards could be around the corner.

The main thing to know here is that silver prices have been getting very low compared to gold prices.

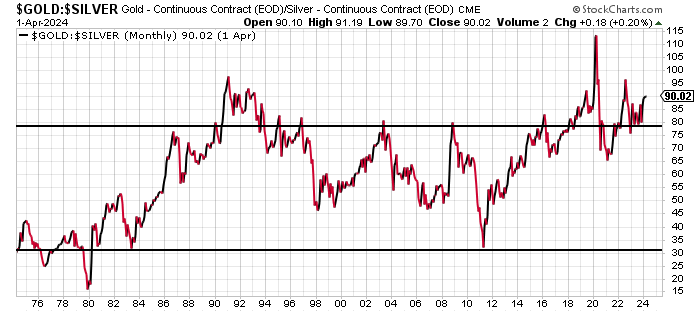

How do we know this? Take a look at the chart below. It plots the gold-to-silver ratio.

This ratio is used by precious metal investors to assess the value of silver. At its core, the gold-to-silver ratio tells us how many ounces of silver it takes to buy an ounce of gold.

Chart courtesy of StockCharts.com

Historically, whenever this ratio moved above 80, silver prices were considered low. When the gold-to-silver ratio dropped below 40, the price of silver was considered to be high.

In fact, in the past 40 years or so, whenever the gold-to-silver ratio has spiked above 80, it has almost always eventually come down to 40—like clockwork.

Now, here’s the kicker: since 2018, the gold-to-silver ratio has remained above 80, except for a little while in 2020. This screams that silver is undervalued.

How High Could Silver Prices Go?

If we look at the gold-to-silver ratio and nothing else, and assume that gold prices will remain constant around $2,200, if the ratio drops to 40, it would mean silver prices would have to be around $55.00!

That’s more than 100% above the current price of silver, and it would put silver in all-time-high territory.

But given the momentum in gold prices and the fundamentals of the yellow precious metal market, it looks like $3,000-an-ounce gold isn’t an out-of-this-world target.

Assuming the price of gold rises to that level, the price of silver would have to surge to $75.00 an ounce for the gold-to-silver ratio to be 40. That translates to upside of about 190% for silver prices (as of this writing).

Here’s How to Speculate on Silver

Dear reader, silver prices haven’t performed as well as gold prices. However, now that gold has been starting to make new highs, I think it’s just a matter of time before silver catches a bid and moves higher.

Looking back at previous market cycles for the gray precious metal, the price of silver eventually does wake up and tends to make a violent move upward. Here’s one more thing: the biggest gains in silver prices tend to happen near the end of a bull cycle.

Now, the big question: Where’s the opportunity for investors?

There are two main options for investors to speculate on silver. However, it must be noted that the options mentioned here aren’t for everyone; some come with more risk than others.

1. Silver bullion or silver-backed exchange-traded funds (ETFs) provide direct exposure to silver prices. This is a low-risk option. However, there may be some advantages to owning silver-backed ETFs versus owning bullion, since ETFs come with lower carrying costs. Owning silver bullion outright could cost a bit.

2. Silver mining stocks could be lucrative, but they’re a risky option. It’s not uncommon to see shares of mining companies provide leveraged returns to silver prices. During silver bull runs, it’s very common to see mining stock prices double, triple, or more in a very short period. To reduce some risk, one could look at ETFs that hold silver mining stocks.